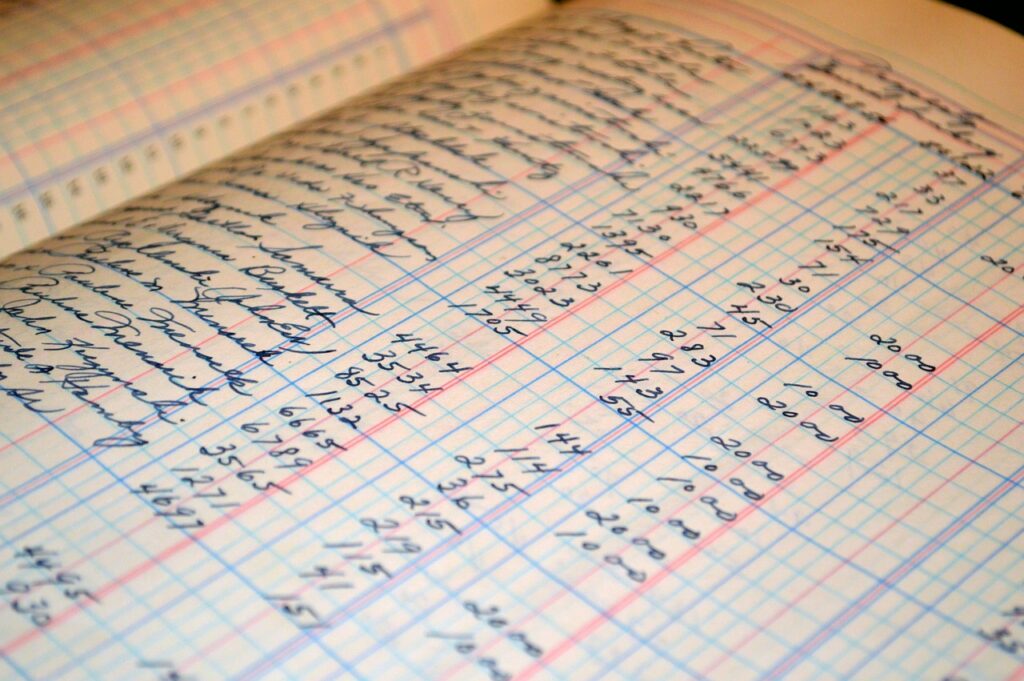

Overview of the general ledger:

All of the organization’s financial transactions are centrally stored in the general ledger, which is kept up to date in compliance with the set financial policy. It offers a methodical log of every debit and credit entry made to different accounts, such as revenue, expenses, equity, liabilities, and assets. All financial data is guaranteed to be accurate, comprehensive, and in compliance with relevant internal controls and accounting standards thanks to this organized recording.

Alignment and Control of Policies:

The organization’s financial policy, which covers approval hierarchies, coding standards, and cutoff procedures, must be followed when posting any entries in the general ledger. These entries are based on supporting evidence, including bank statements, invoices, and receipts. Balances must be checked through monthly reconciliations, and any inconsistencies must be reported and fixed right away. This procedure makes it easier to prepare trustworthy financial statements, guarantees accountability, and guards against fraud.

Compliance and Audit:

To make sure that internal policies and regulatory requirements are being followed, the general ledger is audited both internally and externally. Authorized individuals are the only ones with access to ledger entries, and a change log is kept for audit trails. Management may make well-informed financial decisions based on current and accurate financial data with the support of regular reviews and system controls.

Author : Mohamed Yasin